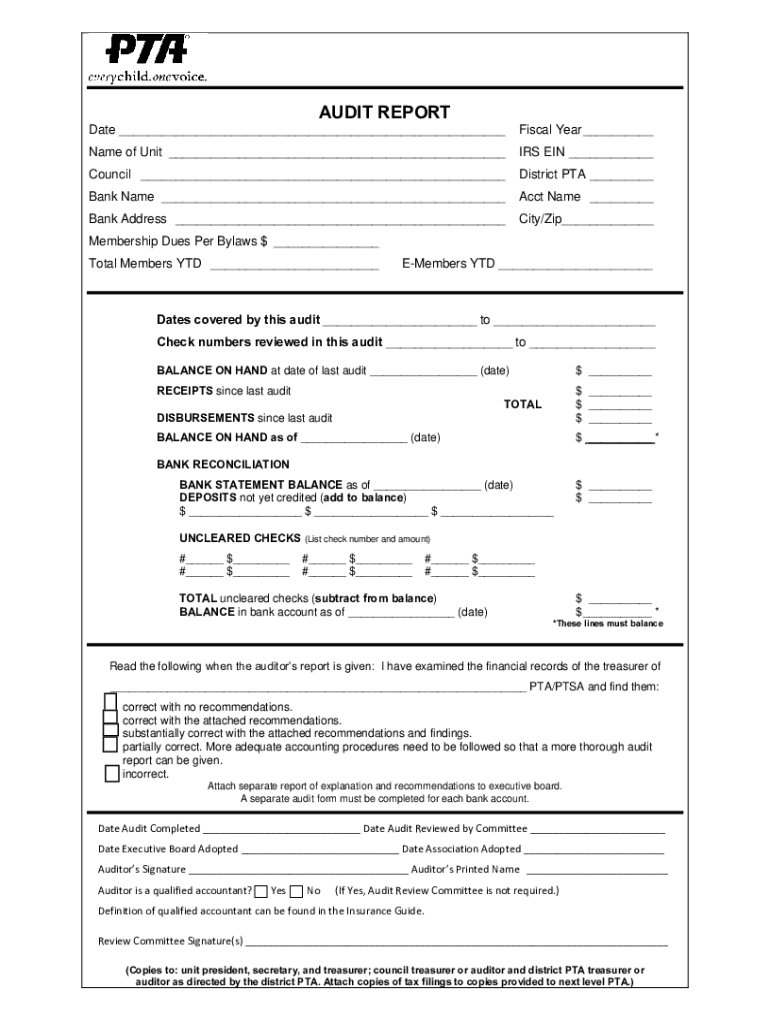

Who needs an Audit report form?

This form is used by the auditors who conduct the official examination of the financial officers and records of the Parent-Teacher Association. The auditor is appointed by the audit committee or hired for a specified period.

What is the purpose of the Audit report form?

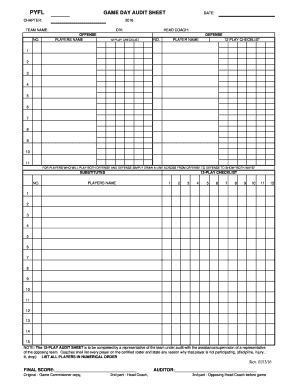

The report provides the results of the official examination of the PTA’s financial officers. The form contains information about the time of the audit, bank and account details, and examination results. This data is forwarded to the PTA executive board for further reference. The separate audit report should be completed for each bank account.

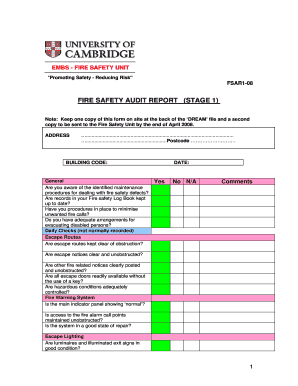

What other documents must accompany the Audit report form?

The Audit Report is usually accompanied by the audit Checklist. In case the auditor has any recommendations or explanations, these reports must as well be submitted. If required, the tax forms accompany this report.

When is the Audit report form due?

The audit examination is conducted when the financial officers of PTA change or when the executive board makes such a decision. In most cases, the audit report is submitted semiannually.

What information should be provided in the Audit report form?

The form contains the following details:

- Date of the audit

- Name of the unit

- Bank name and address

- Fiscal year

- IRS EI number

- Number of bank account

- Covered dates

- Financial information (balance on hand, receipts, bank reconciliation, etc.)

- Information about the auditor

What do I do with the report after its completion?

The completed report is forwarded to the PTA executive board. The unit president, secretary, treasurer, council treasurer and auditor should also receive one copy of the report.